|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

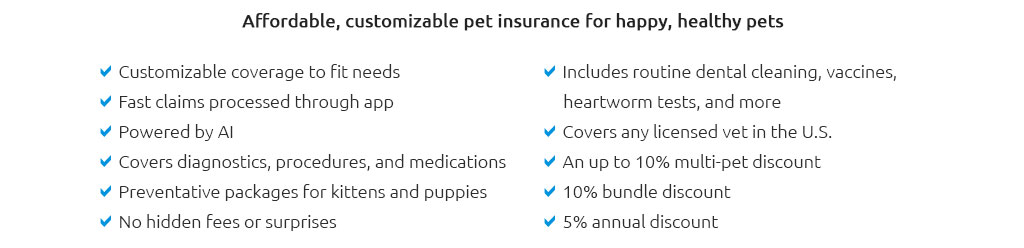

The Unseen World of Health Insurance for Dogs: A Comprehensive GuideIn an age where our canine companions are cherished members of the family, the notion of health insurance for dogs has gained traction, weaving itself into the fabric of responsible pet ownership. Much like their human counterparts, dogs are susceptible to a myriad of health challenges, from routine ailments to more complex conditions. As we embark on this exploration, we shall delve into the intricate tapestry of options available, shedding light on the nuances that define this burgeoning industry. At its core, dog health insurance is a financial safety net, designed to alleviate the burden of unexpected veterinary expenses. The marketplace is teeming with providers, each offering a unique blend of coverage options, pricing models, and service quality. Among the most popular options are Healthy Paws, Embrace Pet Insurance, and Trupanion, each with distinct characteristics that cater to varying needs and preferences. Healthy Paws, renowned for its straightforward approach, offers comprehensive coverage without caps on payouts. This simplicity is appealing to those who value transparency and predictability. However, its exclusion of pre-existing conditions is a point of contention among pet owners who have adopted older or rescue dogs with known health issues. On the other hand, Embrace Pet Insurance distinguishes itself with its customizable policies, allowing pet owners to tailor coverage to their specific requirements. Its Wellness Rewards program is particularly noteworthy, incentivizing routine care and fostering a proactive approach to pet health. Yet, this flexibility comes at a premium, with higher monthly costs that may deter budget-conscious consumers. Trupanion, meanwhile, is lauded for its innovative approach to coverage, eschewing traditional limits and instead opting for a lifetime per-condition deductible. This model is particularly advantageous for chronic conditions, as it prevents the reset of deductibles with each policy renewal. However, the absence of wellness care coverage may be a drawback for those seeking a comprehensive, all-in-one solution. The decision to invest in dog health insurance is not one to be taken lightly, and it is imperative to weigh the pros and cons of each provider in the context of individual circumstances.

As we navigate this landscape, it becomes apparent that the value of dog health insurance extends beyond mere financial protection. It is a testament to the bond between humans and their four-legged friends, a commitment to ensuring their well-being in sickness and in health. FAQWhat does dog health insurance typically cover? Dog health insurance generally covers unexpected illnesses, accidents, surgeries, and sometimes hereditary conditions. However, coverage for routine care and pre-existing conditions is less common and varies by provider. Is dog health insurance worth the cost? The value of dog health insurance depends on several factors, including your dog's health history, breed-specific risks, and financial situation. For many, the peace of mind it provides in covering unexpected veterinary bills justifies the cost. How do I choose the right insurance provider for my dog? Choosing the right provider involves assessing the coverage options, exclusions, costs, and customer reviews. It is beneficial to compare multiple providers and consider what aligns best with your dog's specific needs and your budget. Can I get insurance for an older dog? Yes, many insurers offer policies for older dogs, though premiums may be higher, and some conditions might be excluded as pre-existing. It's important to research and select a policy that accommodates the needs of an older pet. https://www.embracepetinsurance.com/

Pet insurance from Embrace saves you up to 90% back on vet bills from unexpected illness and medical expenses. From dog and cat insurance to wellness ... https://www.geico.com/pet-insurance/

Pet insurance can help manage health costs for your pets. Pet insurance is a specialized health insurance for your beloved pets. Get affordable care for your ... https://www.progressive.com/pet-insurance/

Pets Best offers an affordable, fixed-price pet insurance plan for broken bones, bite wounds, accidental swallowing of foreign objects, and other common ...

|